Phone: +966-50-7024644 | Email: info@ghalibconsulting.com

Table of Contents

Cost of Feasibility Study for Real Estate Projects in Dubai | Expert Guide 2024

Introduction: The Million-Dirham Question

Imagine standing before Dubai’s iconic skyline, envisioning your next real estate project. You’ve secured the land, you have the vision, but there’s one critical step before breaking ground—the feasibility study. This isn’t just another bureaucratic hurdle; it’s the financial compass that determines whether your dream project becomes a profitable reality or a costly lesson.

The cost of feasibility study for real estate projects in Dubai often becomes the first point of serious financial planning, yet many developers approach it with more confusion than clarity. I recall a client who nearly abandoned his Marina residential tower project because he received feasibility study quotes ranging from AED 45,000 to AED 300,000. The disparity wasn’t about overcharging—it was about fundamentally different understandings of what a feasibility study should deliver.

What Exactly Are You Paying For?

A feasibility study in Dubai’s real estate market isn’t a generic report. It’s a multi-layered analysis that must account for:

The Core Components

- Market analysis and demand assessment

- Financial modeling and ROI projections

- Regulatory compliance review

- Risk assessment and mitigation strategies

- Construction and operational cost analysis

Dubai’s Land Department emphasizes the importance of thorough due diligence, requiring developers to demonstrate project viability before approval. This isn’t merely a formality—it’s protection against market saturation and failed projects that could destabilize the sector.

Breaking Down the Costs: Where Your Money Actually Goes

Professional Fees: The Expertise Premium

Consultancy fees typically represent 60-70% of the total cost of feasibility study for real estate projects in Dubai. These vary dramatically based on:

Consultant Tier & Specialization:

| Consultant Type | Average Fee Range | Best For |

|---|---|---|

| Boutique Local Firms | AED 40,000 – 80,000 | Small to medium residential projects |

| Mid-sized Regional Firms | AED 80,000 – 150,000 | Mixed-use developments |

| International Consultancies | AED 150,000 – 300,000+ | Mega-projects & landmark developments |

The Hidden (But Essential) Expenses

- Data Acquisition Costs (15-20% of total)

- Market research subscriptions (REIDIN, Property Monitor)

- Demographic and economic data from Dubai Statistics Center

- Competitor analysis reports

- Technical Assessment Fees (10-15%)

- Site evaluation and soil testing

- Infrastructure connectivity assessment

- Environmental impact preliminary studies

- Regulatory Compliance (5-10%)

- Legal framework analysis

- RERA and DLD requirement assessments

- Free zone vs. mainland considerations

The Project Scale Factor: One Size Doesn’t Fit All

Residential Projects

A 50-unit apartment building in Jumeirah Village Circle requires a fundamentally different approach than a luxury villa community in Emirates Hills. The cost of feasibility study reflects this complexity:

- Affordable Housing Projects: AED 35,000 – 65,000

- Mid-Market Residential: AED 50,000 – 90,000

- Luxury Developments: AED 80,000 – 150,000+

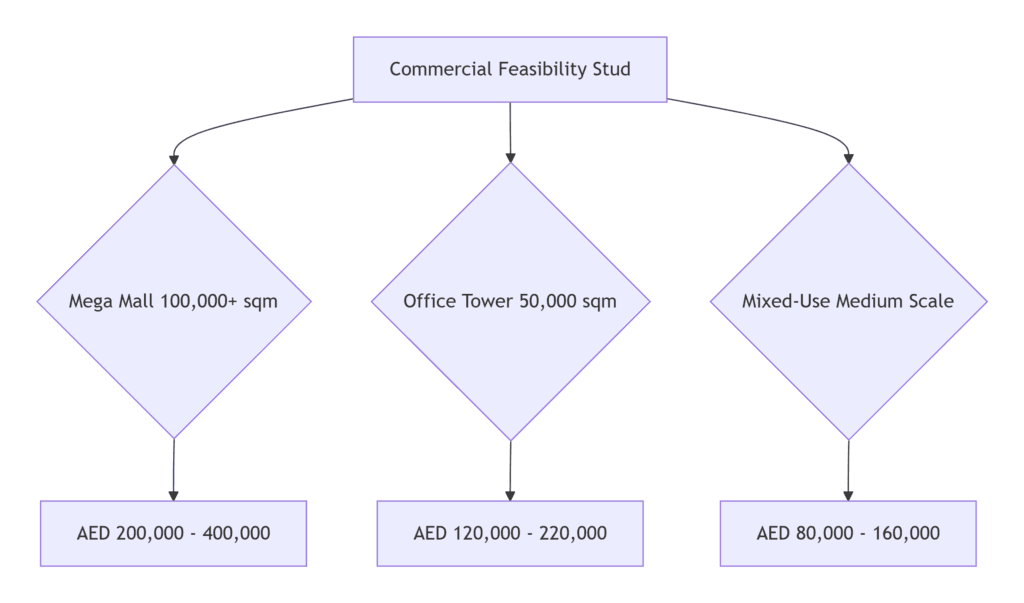

Commercial & Mixed-Use Developments

Dubai’s evolving commercial landscape, particularly in areas like Dubai Hills Estate and Downtown Dubai, demands more sophisticated analysis:

The Timing Conundrum: When Costs Spike

Market Phase Considerations

During Dubai’s 2021-2023 boom period, feasibility study costs increased by approximately 25-30%. High demand for qualified consultants, coupled with urgent project timelines, created a premium for rapid, comprehensive analysis.

Project Stage Impact

- Concept Stage: Basic viability (AED 25,000 – 50,000)

- Pre-Design Phase: Detailed analysis (AED 50,000 – 120,000)

- Financing Stage: Bank-ready documentation (AED 75,000 – 180,000)

A common pitfall? Developers who commission feasibility studies too late, after significant design investment, only to discover fundamental viability issues. The earlier the study, the more you save in potential redesign costs.

The ROI Perspective: Why “Cheap” Can Be Expensive

I’ve witnessed projects where saving AED 30,000 on a feasibility study led to:

- Overestimated occupancy rates by 15-20%

- Missed regulatory changes affecting project timelines

- Underestimated infrastructure costs by millions

Consider this: A well-executed feasibility study typically costs 0.1-0.3% of total project value but can identify savings or optimize returns representing 5-15% of project value.

Dubai-Specific Considerations That Affect Costs

Regulatory Complexity

Dubai’s real estate regulations are dynamic. Recent RERA updates, new sustainability requirements (like the Dubai Green Building Regulations), and evolving off-plan sales regulations all require specialized knowledge that affects study complexity and cost.

Market Volatility Factors

Dubai’s real estate market has distinct characteristics affecting feasibility studies:

- High percentage of international investors

- Seasonal demand fluctuations

- Government policy impacts (golden visas, corporate tax implications)

Choosing Your Consultant: Beyond the Price Quote

Critical Selection Criteria

- Local Market Mastery: Understanding Dubai’s micro-markets (differences between Dubai Creek Harbour vs. Dubai South, for instance)

- Track Record: Proven experience with similar project types

- Methodology Transparency: Clear explanation of assumptions and data sources

- Post-Study Support: Availability for follow-up and adjustments

Red Flags to Watch

- Unrealistically low quotes (often indicating cut corners)

- Generic, template-based proposals

- Lack of Dubai-specific case studies

- Vague methodology descriptions

The Ghalib Consulting Difference: Value Beyond the Report

At Ghalib Consulting, we approach feasibility studies not as a deliverable, but as a partnership. Our process includes:

Proprietary Analysis Framework

We’ve developed Dubai-specific financial models that account for:

- Local financing structures and Islamic finance considerations

- Dubai’s unique operating cost structures

- Regional economic interdependencies

Integrated Risk Assessment

Beyond standard financial analysis, we evaluate:

- Geopolitical factors affecting investor sentiment

- Supply chain vulnerability for construction

- Climate adaptation costs (increasingly crucial for long-term viability)

Practical Cost-Saving Strategies

Smart Planning Approaches

- Phased Analysis: Start with a high-level assessment before committing to full study

- Template Customization: Use standardized frameworks adapted to your specifics

- Collaborative Data Sharing: Provide available information to reduce consultant research time

Timing Optimization

- Avoid peak seasons (Q4 and Q1 typically have longer lead times)

- Align with market research publication cycles

- Consider parallel processing of study components

The Future of Feasibility Studies in Dubai

Technology Integration

Advanced tools are changing cost structures:

- AI-driven market analysis reducing data processing time

- BIM integration allowing more accurate cost estimation

- Blockchain for transparent supply chain costing

Sustainability Mandates

Dubai’s Net Zero 2050 initiative means feasibility studies must now include:

- Carbon cost analysis

- Green financing availability assessment

- Long-term operational efficiency projections

Conclusion: An Investment, Not an Expense

The cost of feasibility study for real estate projects in Dubai represents one of the most leveraged investments a developer can make. It’s the difference between navigating Dubai’s competitive landscape with confidence versus stumbling through expensive trial and error.

The true value isn’t in the report itself, but in the informed decisions it enables—decisions that can mean the difference between a project that defines Dubai’s next iconic skyline addition and one that becomes a cautionary tale.

Your Next Step: Beyond the Numbers

At Ghalib Consulting, we believe every great Dubai project begins with the right questions, not just the right answers. If you’re evaluating a real estate opportunity in Dubai, let’s discuss not just what a feasibility study costs, but what it should deliver for your specific vision.

Contact us today for a preliminary assessment that clarifies both the investment required and the value gained. Because in Dubai’s dynamic market, the right insights don’t just cost money—they make money.